I look at my macOS Sonoma 14.5 screen for a couple of hours a day. I wasn’t a fan of how Google and Adobe placed their icons in the menu bar, as I never need them. When GPT-4 added its icon—which is actually helpful for me—I felt that cleaning up that part of my surroundings would be nice.

So, I learned about Bartender 5. I’m not sure if I will end up spending money (22EUR) to have a tidy upper right corner of the screen. Installation was simple, albeit a bit surprising since the app needs permission to screen record and access another setting, which I later disabled. So far, the menu bar has not reverted.

If you’re befuddled like me by the Byzantine mess that Mac preferences have become, check Privacy & Security > Accessibility and Screen Recording if you’d like to revert the settings after the menu has been set to your liking.

Some Concerns About Bartender 5

Seemingly—and I learned this only after my installation—the single developer, Ben Surtees, sold his wonderful and intricate app to Applause.dev earlier in 2024. It wasn’t smooth sailing. It’s not reassuring that Applause.dev seems to have no list of applications they have purchased so far. Their website only caters to developers who are looking for a cash exit.

I feel that Ben is totally fine with selling what he built. The app looks and works amazingly well. Single developer apps sometimes have a five-star restaurant touch to them. Only a person who cares intensely can get all those details right. More often than not, it never happens.

The world, however, does not automatically and magically reward individuals for their efforts. Regardless of how awesome somebody codes and thinks, linear scaling the revenue based on the efforts is—sadly—not a reality at all. It’s insane that this myth lingers, much like the lingering scent of perfume in an empty subway tunnel—ephemeral. It might even just have been a shattered perfume bottle a perfect while ago.

Challenges of Being a Single Developer

Applause.dev probably has no shortage of developers trying to sell what they’ve made. Life as a single developer is hard as it is: Customers expect support from everywhere in a non-linear fashion. Three percent of the prospects create 90% of the troubles and work, and of those, most will not even buy.

To make it worth your while, you want to have around 200,000 in revenue a year. At that number, you would still be better off financially in some corporation. Let’s assume that’s not your thing, and that you’re not in the daily-ramen phase of your life either. For an app, that means 10,000 people a year need to go through the motions. Let’s assume an amazing conversion rate of 20%. You have to deal with roughly four sad/bad/stupid/horrible people a day. All the while, you must be nice, since you can’t afford the potential backlash of losing your temper in the wrong way. That alone takes at least one hour out of each day, every day. If you take a weekend off, there are eight more of those waiting on top of the four that come each day.

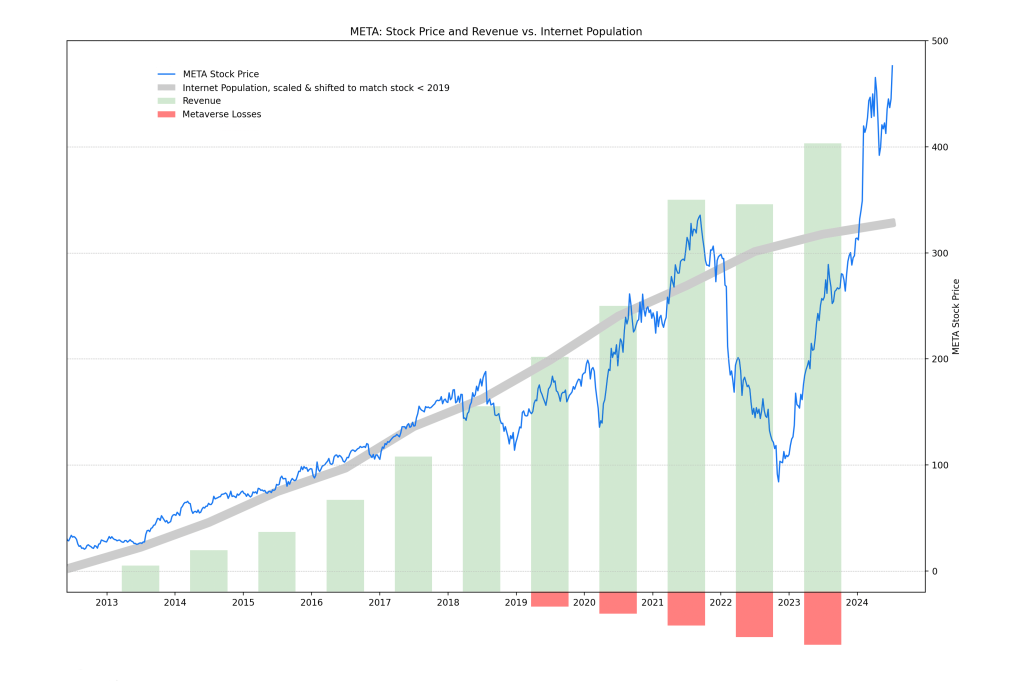

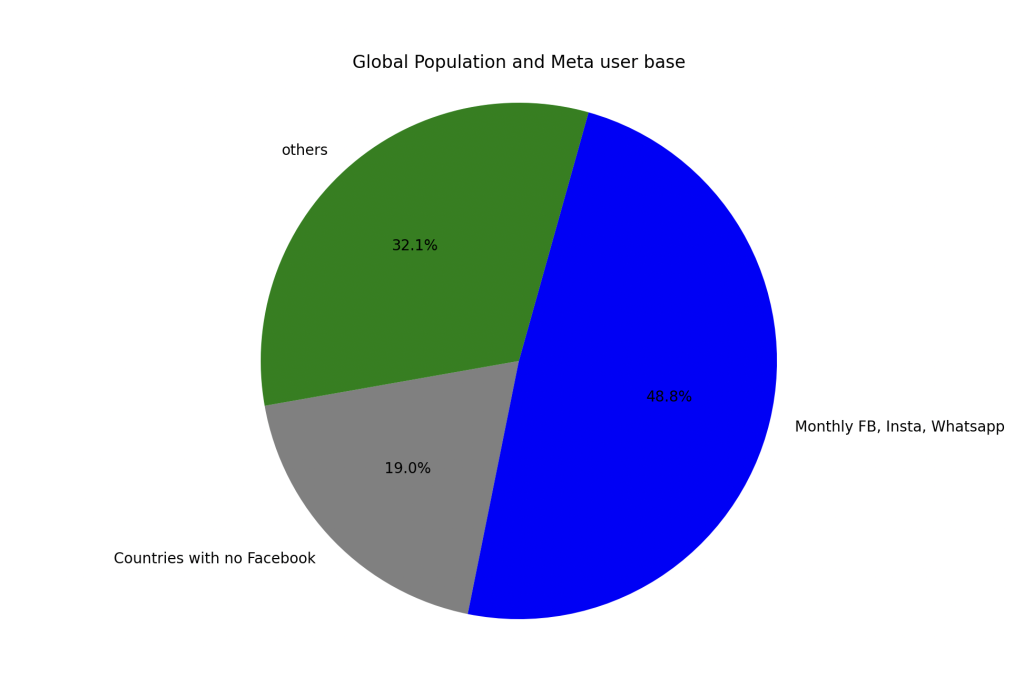

Of course, you need to funnel them to you, which is even harder and becomes increasingly difficult each month. The internet is full of content—so full that you have basically zero organic reach now. You need to pay Google or Meta for eyeballs, and the cost of that increases continuously.

So, wanting to exit makes sense. I get it.

The Bright Future of Single Developers

On the other hand, the future for single developers—and, in turn, for us—is incredibly bright. A person who knows what they are doing can implement many things between 4 and 20 times faster than just a year ago. So, the scale of what that one-person bottleneck can churn out is absolutely amazing. I predict that we will see a rise in single-person solutions that will make all our lives so much better. I feel that this will be the first real, positive impact of transformers and the abundance of CUDA compute: single people doing things where you once needed 20 developers. And if you have 20 good developers, you usually need between 100 and—how many people do Meta, Google, and Apple have again?—around them. OK, maybe a bit over the top with that one. But six weeks ago, we all learned the hard way that Crowdstrike only had 19 and not 20 good developers among the 8,000 people they employ.

What Will I Do with My Menu Bar?

So, what will I do with my menu bar? For now, nothing. In four weeks or the next time I log out, I will have to consider whether I should turn my network off, give Bartender the rights it needs, change the settings again, and move on. Or should I look at a free alternative like Ice?

Or just go back to the old ways. Not sure.

Bartender is tricky, though. I don’t think Applause is particularly evil—they could be, they could not be—but having an app install base of Mac users who most likely let the config options for controlling your computer and making screen recordings on makes them a very juicy target for malicious third parties. Or is that a fourth party in this constellation? Not something I’m eager to partake in.

September 18, 2024: With the macOS 15 update Bartender vanished, since I didn’t give it any permissions.

Turns out installing Ice is super simple, and using it equally so. It also wants screen recording and accessibility permissions. Other as with Bartender, it wants to keep those permissions, otherwise the view reverts to its default.

Summary

To sum it up, Bartender 5 offers a sleek solution to tidy up your macOS menu bar, but the transition of ownership from a single developer to a larger company raises questions. While the future of single developers looks promising, the challenges they face are significant. As for Bartender, whether I stick with it or explore alternatives like Ice, I’ll keep a close eye on how things evolve—both in the software itself and in the security concerns that come with it.